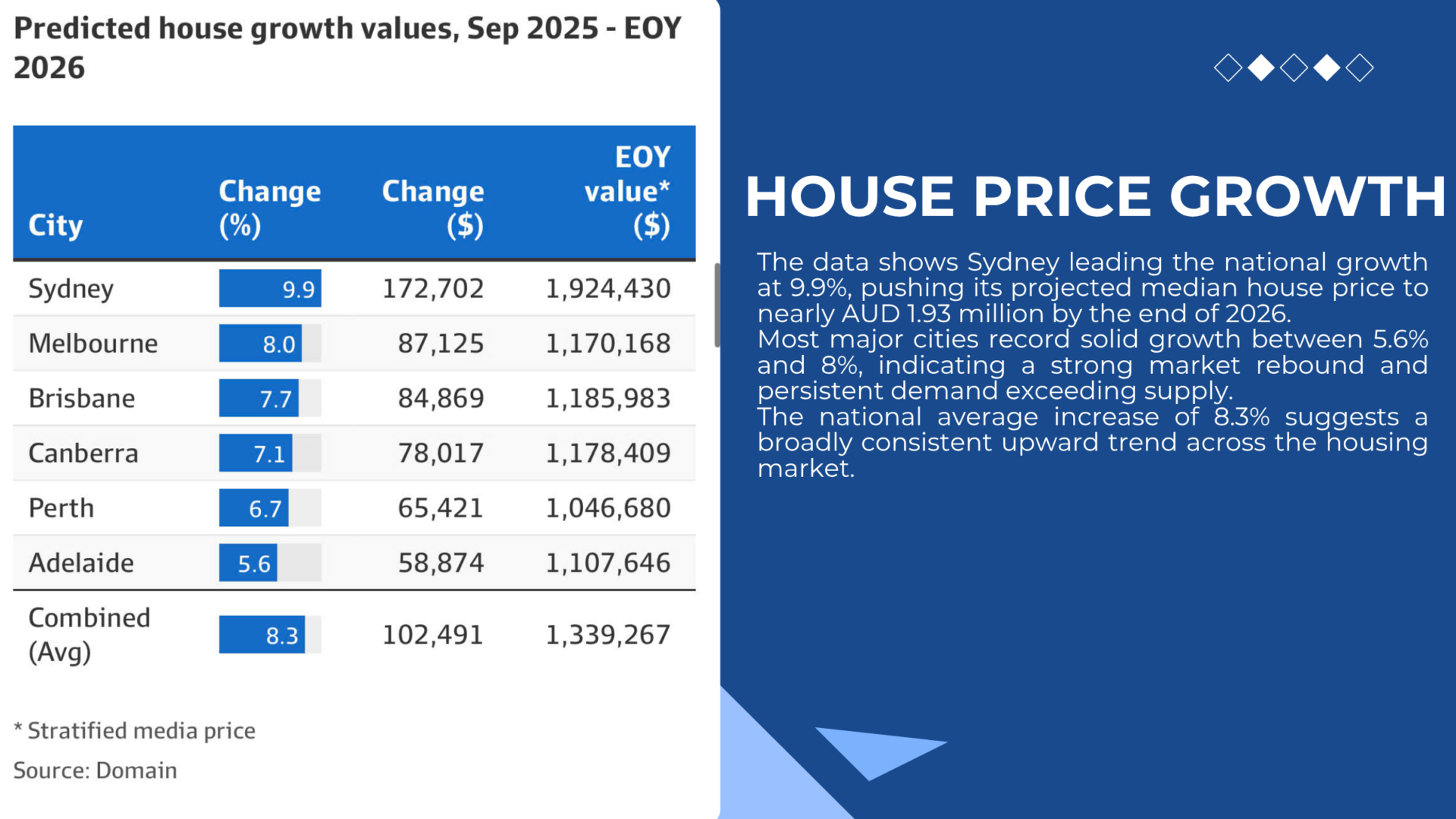

Recent forecasts indicate that Sydney’s median house price may reach AUD 1.9 million by 2026, with all major cities expected to hit new record highs. The primary driver is a significant shortage of housing supply, while demand remains consistently strong due to population growth, migration, and shifting household structures.

Recent forecasts indicate that Sydney’s median house price may reach AUD 1.9 million by 2026, with all major cities expected to hit new record highs. The primary driver is a significant shortage of housing supply, while demand remains consistently strong due to population growth, migration, and shifting household structures.

This supply gap creates clear, direct opportunities for building material suppliers and housing providers:

- Strong growth in new-home construction: Rising prices and limited supply push developers to accelerate new housing projects, particularly detached homes and low-rise builds in outer metropolitan areas—boosting demand for cement, steel, aggregates, and finishing materials.

- Rising demand for renovations and upgrades: As property values increase, homeowners are more willing to invest in extensions, structural upgrades, and improvements—driving additional volume for material suppliers.

- FOMO-driven market momentum: The shift from downturn to recovery accelerates buying decisions, raising pressure on developers to deliver more homes quickly.

- Momentum in affordable and outer-suburban housing: High city prices encourage buyers and governments to focus on affordable housing and outer-suburban developments, opening new markets for construction and material supply.

- Long-term expansion potential: The supply deficit highlights a nationwide need for sustained building activity, enabling material suppliers to scale operations, strengthen supply chains, and secure long-term contracts.

Australia’s housing market is entering a phase of rising prices and structural undersupply. This environment presents a strong growth window for material suppliers, distributors, and housing developers to expand capacity, secure partnerships, and capture long-term market demand.